Classic Grid

RoosterVanaf:

19.99

MT4: Beschikbaar

MT5: Niet beschikbaar

Hedge: Niet vereist

Broncode: Niet beschikbaar

Gratis test/demo: Beschikbaar

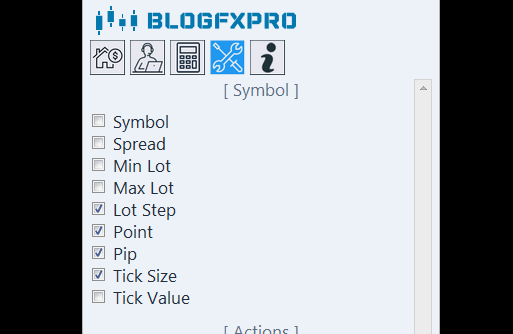

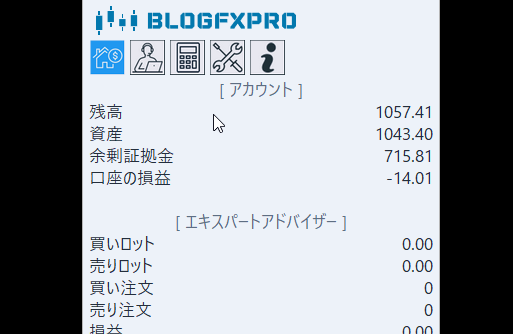

| Magic Number | This is a unique identifier for the "Classic Grid" Expert Advisor, allowing you to distinguish its trades from those of other EAs in your account. It helps prevent interference between multiple trading strategies running concurrently. |

| Max Spread | This input specifies the maximum allowable spread in pips at which the EA can execute trades. If the actual market spread exceeds this value, the EA will not place new orders, helping to ensure that trades are executed under favorable conditions. |

| Lot Exponent | Lot Exponent is a multiplier that determines the lot size for the next order in the recovery grid. It allows you to control the increase in lot size as additional orders are placed, helping to manage risk and exposure as the grid expands. |

| Initial Lots | This input defines the lot size for the first trade initiated by the EA. It sets the starting point for the grid of trades and can be adjusted based on your risk tolerance and trading strategy. |

| Stop Loss | Stop Loss is the price level, specified in pips, at which the EA will automatically close a losing trade to limit potential losses. It acts as a safety net to protect your capital from excessive drawdown. |

| Take Profit | Take Profit is the price level, also in pips, at which the EA will automatically close a winning trade to lock in profits. It allows you to set a predefined target for your trades to capture gains. |

| Distance | Distance represents the spacing between orders in the grid, measured in pips. It determines how close or far apart each order in the grid will be placed, affecting the overall trading strategy's dynamics. |

| Max Level | Max Level specifies the maximum number of levels or tiers in the grid. It controls how many additional orders the EA can open as price movements trigger new trades. Be cautious not to set this too high, as it can increase exposure and risk. |

| Slippage | Slippage refers to the maximum allowable difference between the requested price and the executed price of a trade. It accounts for potential price fluctuations during order execution. |

| Order Comments | Order Comments provide a way to label the orders generated by the "Classic Grid" EA. This can be helpful for tracking and distinguishing these orders in your trading history, especially if you use multiple EAs or strategies simultaneously. |

Emma Schmidt

• 17-03-2025

Gibt es eine Option, um eine Funktion hinzuzufügen, die sich an veränderte Marktbedingungen anpasst und die Rasterparameter entsprechend optimiert?

Madison Wilson

• 11-03-2025

Could you implement a trailing stop feature to maximize profits as the market moves in our favor?

Omar Abdullah

• 27-12-2024

يُرجى النظر في إضافة ميزة لضبط معلمات الشبكة تلقائيًا استنادًا إلى تقلب السوق، مما قد يعزز من قدرة التكيف.

Amir bin Aziz

• 15-01-2024

Mengikut sesebuah forum komuniti atau sembang sokongan di mana pengguna boleh bertukar pendapat dan strategi akan memperkuatkan komuniti pengguna yang lebih kuat.

Noah Adams

• 30-12-2023

Is there a way to integrate news sentiment analysis to avoid trading during major news events that can cause significant price spikes?

Riya Singh

• 05-08-2023

Consider adding an option to set a maximum drawdown limit to ensure that the EA doesn't exhaust too much of the account's equity.

Isla Anderson

• 25-04-2023

It would be helpful to include an email or SMS notification system for important events like trade openings, closures, or margin alerts.

Charlotte Clark

• 13-01-2023

Is there a plan to make "Classic Grid" compatible with additional trading platforms beyond the current ones?

Sara binti Mahmud

• 23-06-2022

Bolehkah anda sediakan dokumentasi yang lebih terperinci dan panduan pengguna untuk membantu pedagang memahami dan mengoptimumkan tetapan EA?

Noah Fourie

• 01-05-2021

A graphical user interface (GUI) for easier setup and configuration would be a welcome addition for less experienced traders.

Riya Singh

• 17-02-2021

Consider adding a backtesting feature so users can assess the EA's historical performance under different market conditions.

Oliver Wilson

• 03-10-2020

Are there any plans to offer different grid strategies or presets to cater to different trading styles and preferences?

Nederlands (Nederland)

Nederlands (Nederland)