EUR/USD analysis - Why doing nothing is the best trade!

3.1.2026

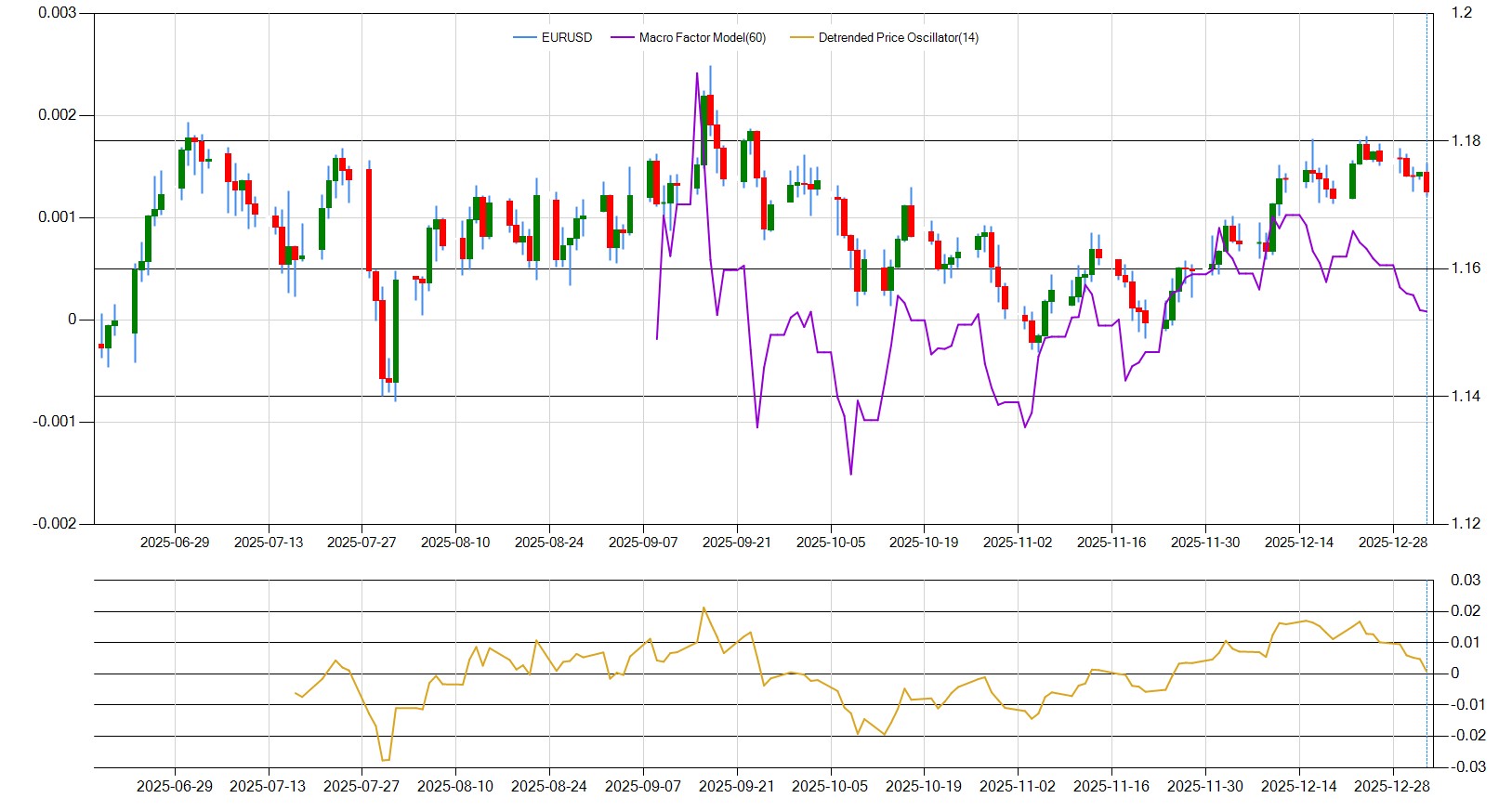

EUR/USD looks deceptively active, but the data tells a different story. Volatility has collapsed to the lowest levels in months, a classic setup for frustration rather than profit. When markets enter this regime, price movement tends to chop sideways, punishing both breakout traders and trend followers.Fundamentally, the picture is mixed. Yield differentials are no longer aggressively bearish for the euro, and macro factors have turned slightly supportive. However, this improvement is gradual and lacks the momentum needed to justify a strong directional bet. In other words, downside pressure has eased — but upside conviction is missing.Technicals reinforce the caution. Volume-based indicators point to distribution, not accumulation, suggesting that recent strength is being sold into rather than built upon. Momentum indicators are weak but not extreme, offering no clean mean-reversion or trend-following edge.The result is a market with just enough bullish signals to tempt buyers — and just enough bearish signals to punish them. Until volatility expands and participation improves, the highest-probability decision isn’t BUY or SELL. It’s patience.

EUR/USD looks deceptively active, but the data tells a different story. Volatility has collapsed to the lowest levels in months, a classic setup for frustration rather than profit. When markets enter this regime, price movement tends to chop sideways, punishing both breakout traders and trend followers.Fundamentally, the picture is mixed. Yield differentials are no longer aggressively bearish for the euro, and macro factors have turned slightly supportive. However, this improvement is gradual and lacks the momentum needed to justify a strong directional bet. In other words, downside pressure has eased — but upside conviction is missing.Technicals reinforce the caution. Volume-based indicators point to distribution, not accumulation, suggesting that recent strength is being sold into rather than built upon. Momentum indicators are weak but not extreme, offering no clean mean-reversion or trend-following edge.The result is a market with just enough bullish signals to tempt buyers — and just enough bearish signals to punish them. Until volatility expands and participation improves, the highest-probability decision isn’t BUY or SELL. It’s patience.

suomi (Suomi)

suomi (Suomi)